Resident Travel Policy

The Department encourages residents to submit their clinical and basic science research efforts to significant meetings in the United States for presentation. The Department will endeavor to help fund domestic travel for residents who are first authors to present their paper/podium presentation or their poster (limit one poster per academic year), providing certain provisions and expectations are met. Representation on national committees for which there was a selection process is treated the same as first author papers.

Papers and posters may be submitted to international meetings, but the department does not fund expenses for foreign travel. Foreign travel and expenses are the responsibility of the submitter/sponsors/mentors.

Travel assistance is a privilege, not a given. We need residents to be good stewards of the Department's resources, and to meet the Department at least halfway in using common sense and cost-saving measures. All travelers are expected to exercise good judgement on behalf of Vanderbilt and should avoid unnecessary expenses.

For reimbursement purposes, requests and notification for meetings and travel need to be approved in advance in writing via the Resident Time Away Request form. Tickets need to be purchased in advance via Concur only to optimize savings; days of travel may need to be adjusted to take advantage of fares; searching for the best prices for hotels is encouraged.

Traveler MUST gain pre-travel approval before booking any travel related expenses, and must book all travel through Concur.

Specific guidelines and limits

All reimbursement, travel and non-travel (ie-book fund, loupes reimbursement) will be done through Concur, Vanderbilts travel and reimbursement system.

Pre-travel approval is required prior to the booking of any travel expenses. Travel expenses made prior to approval are the financial responsibility of the traveler and may not be reimbursed. Residents MUST have pre-travel approval before any travel expenses are incurred.

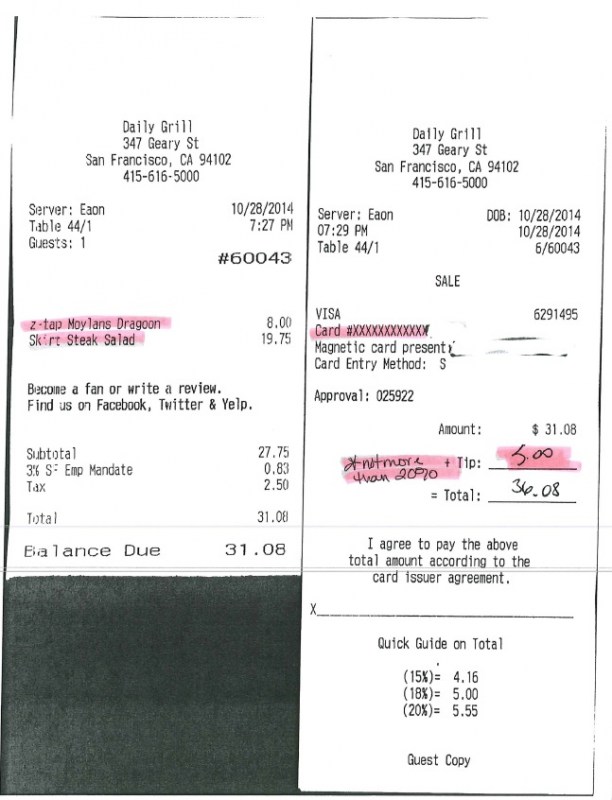

Receipts are mandatory. Original, itemized and proof of purchase receipts are required (see examples below).

Each resident is required to create a profile in Concur.

Flight

Concur MUST be used to book the flight. Airline travel upgrades are considered a personal expense and are not reimbursable expenses. Flight changes must be approved before change is made.

Hotel

The conference website or hotel block may be used to book a room, or by some other reasonable means. Please do not use Hotels.com or Expedia, etc, as these companies do not provide a daily itemized receipt that is required by VUMC travel policy. The hotel folio (bill) MUST reflect a $0 balance and include the last four digits of the credit card used to pay. If there are in-room meal/mini bar charge, itemized receipts must be provided. The proof of payment will be the hotel folio itself. If multiple residents are attending the same conference, residents will be asked to share rooms (when appropriate) or pay for half the hotel room cost if bringing a non-resident guest and a share-option is available.

Registration

Registration fees for the conference should be paid by the traveler with a personal credit card after receiving pre-travel approval.

Rental Car

Most of the time, it is more economical to use taxi cabs/public transportation rather than a rental car for professional travel. Automobile rental will not be reimbursed without clear justification (before the trip) of the need for a rental instead of another mode of transportation. Keep in mind that fuel tax and insurance will not be reimbursed.

Meals

Meal reimbursement is based on actual expense and should not exceed $100 per day per approved attendee. Original, itemized receipts and proof of payment MUST accompany any request for reimbursement for meals. Alcohol is excluded and is not reimbursable. Meal tips are reimbursable up to 20%.

Time Away

Both the ABS and ACGME have guidelines as to what constitutes time away during a conference.

According to the ACGME (Policies and Related Materials (acgme.org)):

If attendance at the conference is required by the program, or if the resident is a representative for the program (e.g., he/she is presenting a paper or poster), the hours should be recorded just as they would be for an on-site conference hosted by the program or its sponsoring institution. This means that the hours during which the resident is actively attending the conference should be recorded as duty hours. Travel time and non-conference hours while away do not meet the definition of duty hours in the ACGME requirements.

According to the ABS (www.absurgery.org):

All applicants must complete 48 weeks of full-time clinical activity in each of the five years of residency, regardless of the amount of operative experience obtained. To provide some flexibility, the 48 weeks may be averaged over the first three years of residency, for a total of 144 weeks required in the first three years, and over the last two years of residency, for a total of 96 weeks required in the last two years. All time away from clinical activity must be accounted for on the application form.

As such, you must record time spent actively in sessions as duty hours. However, when considering your application to ABS (to sit for the qualifying exam), the days are considered away from clinical training. There is some flexibility so that they shouldnt count as vacation (as long as not excessive). Please contact us with any clarifying information needed, and be sure to register any time away in Sharepoint.

Chief Meeting

Each categorical resident is granted a meeting to attend for non-participatory purposes in their chief year or during another year, as approved by the Program Director.

Misc.

Entertainment, health club expenses, video rentals, tips for maids/bell hops/valets and valet parking, etc are not allowable and thus will not be reimbursed.

Other than meals, social activities and travel outside the meeting and hotel venues, are considered personal expenses and are not reimbursable.

Requests for reimbursement for travel must be submitted within 45 days of return from travel, or your reimbursement will be taxable income. Detailed receipts are expected to support any reimbursement requested.

All individuals who travel on behalf of the Department are responsible for knowledge of these policies. Questions should be directed to Kate Kmiec. Below are very specific examples of receipts.